In Fall 2020, Sound Communities partnered with the University of Washington Runstad Department of Real Estate and the Cities of Everett, Renton, and Tacoma, to assess the potential uses and impacts of Housing Benefit Districts (HBD). Key areas of inquiry were:

- Station Area Investment Strategies

What potential station area planning and land acquisition strategies could HBD funds be applied towards to catalyze community growth and development? - Housing Production

How many additional housing units would be generated as a result of HBD fund investments? - Affordable Housing Production

How many additional affordable housing units, ranging from extremely low income to middle income housing, would be generated as a result of HBD fund investments? - Tax Revenue

How much additional property value, and other tax revenues would be generated as a result of HBD fund investments?

Proposed Station Area Investment Strategies

Site Selection

The selection process for the sites involved assessing and prioritizing cities in sets of three against the following criteria:

- Geography: Representation from each of the three counties (Snohomish, King and Pierce) within the scope of ST3

- Racial Equity: A high average percentage of BIPOC (black, indigenous, or people of color) residents (in particular, black residents)

- Income Diversity: A range of average income

- Political Will: Political support for public investment in transit oriented development

- Potential Impact: Estimated potential impact of the proposed intervention, based on range of current and future land uses, and corresponding range of building types and residential densities.

Sound Communities ultimately selected the cities of Everett, Renton, and Tacoma for the study as they scored the highest using the above criteria. Renton was also selected as a Bus Rapid Transit center study to complement the Light Rail station area studies in Everett and Tacoma.

Methodology

Prior to the Fall 2020 studio, Sound Communities contracted with CityBldr, a Seattle-based technology company that uses artificial intelligence and machine learning to determine projected property values, as the primary source of data for this project. Each team used CityBldr-provided information on all individual properties within the half mile radius of the station area to inform and evaluate the performance of their investment strategies. The information included site-specific data such as zoning, lot size, and floor area ratio. Gross land value and land value by unit was determined by CityBldrs proprietary rating of a property’s potential development value.

Key parameters and assumptions for the project included:

- Cumulative land appreciation of 20% for each 5 year period

- Each of the three study areas assumed a half mile radius from the station location as a study boundary

- Students were to assume $50M for land acquisition from the HBD and $25M for infrastructure and related investments from local/regional/state funding streams (over a 20 year period) for each station area

- Land set aside for affordable housing would be resold at the original acquisition cost to affordable housing developers when projects were ready to begin construction. The Housing Benefit District would absorb its holding costs through interim use income streams such as parking or short term rentals.

- HBD acquired lands would be resold to for-profit or non-profit housing developers with restrictions that ensure the following residential unit mix for new development:

- 33% Extremely Low to Low Income

- 5% Extremely Low income (less than 30% Area Median Income)

- 10% Very Low Income (less than 50% AMI)

- 18% Low Income (less than 80% AMI)

- 33% Workforce Housing (80-120% AMI)

- 33% Market Rate Housing (120% AMI)

- 33% Extremely Low to Low Income

Proposed Station Area Investment Strategies

The Everett Station team applied the $50 million land acquisition funds to purchase 114 distinct parcels accounting for nearly 46 acres of developable land, over four phases each lasting approximately five years. This was accompanied by infrastructure investments that applied the $25 million infrastructure funds to create a pedestrian-friendly corridor from 34th and Cedar to Angel of the Winds Arena.

The Renton BRT team applied the $50 million land acquisition funds to purchase and assemble 27 parcels totaling approximately 56.5 acres of developable property, over four phases, each lasting approximately five years. This was accompanied by infrastructure investments that applied the $25 million infrastructure funds towards a variety of activities including: a Planned Action Environmental Impact Study (EIS) in year 1 ($1M), city infrastructure/impact fees in year 3 ($5M), Grady Transportation Corridor improvements in year 3 ($10M), public park & open space in year 7 ($5M), and a parking structure in year 12 ($4M).

The Tacoma Dome Station team applied $38 million in land acquisition funds to assemble 36 parcels totaling 7.3 acres of developable property, over two phases, each lasting five years. The smaller, compared to the Everett and Renton BRT station strategies, investment in land acquisition reflects the unique land constraints at this site which include I-5 and I-705, the waterway, industrial lands, and topography. This land acquisition strategy was accompanied by infrastructure investments that applied the $25M in funds toward a sidewalk expansion ($1.5M), a bike lane with planters ($2M), and underpass improvements at 2 sites in phase one ($1M). In phase two, the team proposed new green space and green stormwater infrastructure ($9.2-15M), additional street improvements ($2M), and park improvements with the LeMay Car Museum ($4.3M).

Projected Impacts

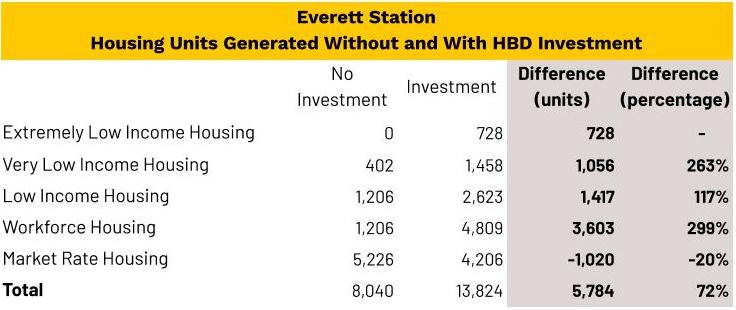

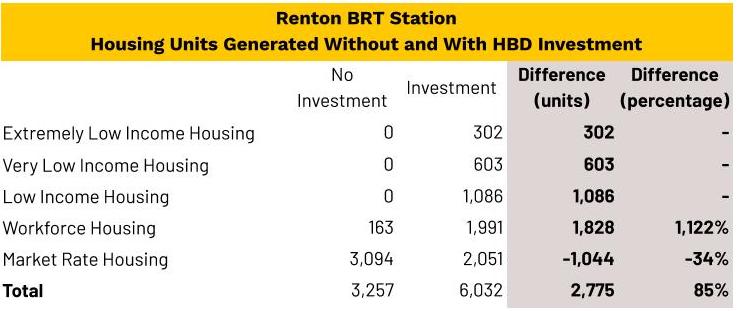

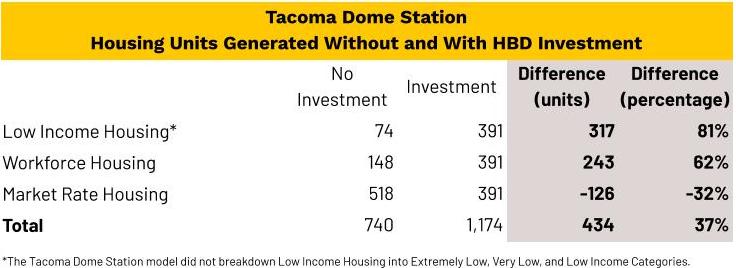

The intervention of public investment in the form of the Housing Benefits District would create more housing units than would be created by the free market alone. In Everett, 5,783 more units would be created as a result of the investment, representing an increase of 72% above the number of units that would have been created by the free market alone. More importantly, public investments coupled with affordability requirements would create significantly higher rates of affordable housing units for extremely low, very low, and low income households that, in the unregulated free market development, would either be produced very minimally or not at all.

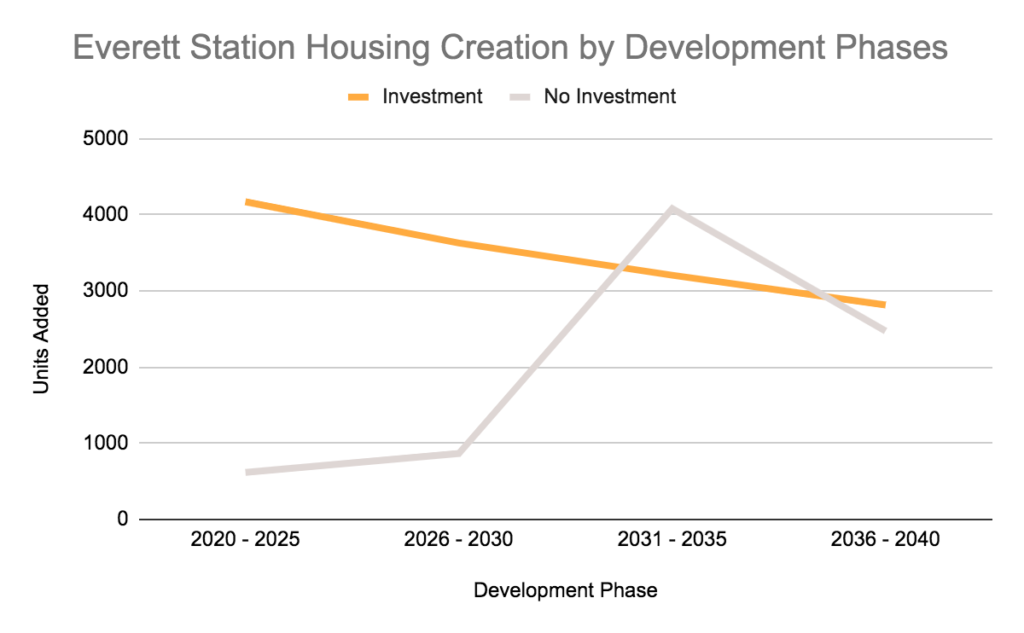

Public investment would also induce the construction of significantly more housing units earlier in the development cycle, in which development would otherwise occur closer to the transit station opening date. The graph below illustrates this contrast in Everett where, the HBD investment scenario (orange) generates much more housing early, over 4,000 units, in the development cycle compared to the non-investment scenario (grey) producing only around 600 units to start off with.

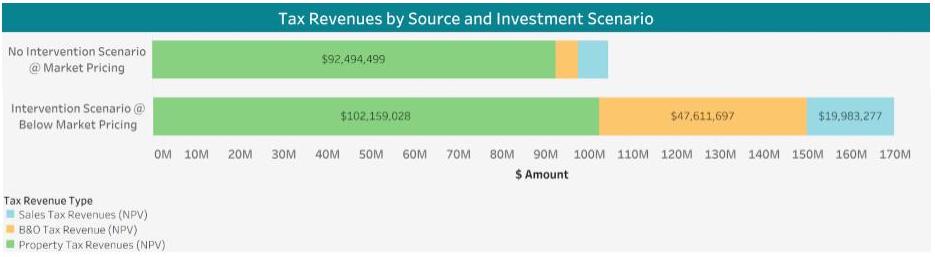

Lastly, building more units and building earlier, contribute to increases in tax revenue, both in one-time taxes as well as recurring taxes. This was illustrated most clearly in the case of Everett, below.

Next Steps

The student teams’ preliminary modeling and research demonstrate that public investment intervention will create increased housing quantity, a significant increase in affordable housing for low-income and middle-income housing, and positive financial outcomes for jurisdictions. However, additional study is required to further refine the assumptions used in these models and to incorporate additional variables such as current housing requirements and incentives that would accelerate housing production and financial returns. Sound Communities is seeking additional funding to build off of this studio project and continue collaborating with the Cities of Everett, Renton, and Tacoma to conduct the necessary preparation for them to assess and implement acquisition tools that would create additional affordable housing, as well as prevent and mitigate the displacement of low income and BIPOC households in these communities.